About FICO® Scores

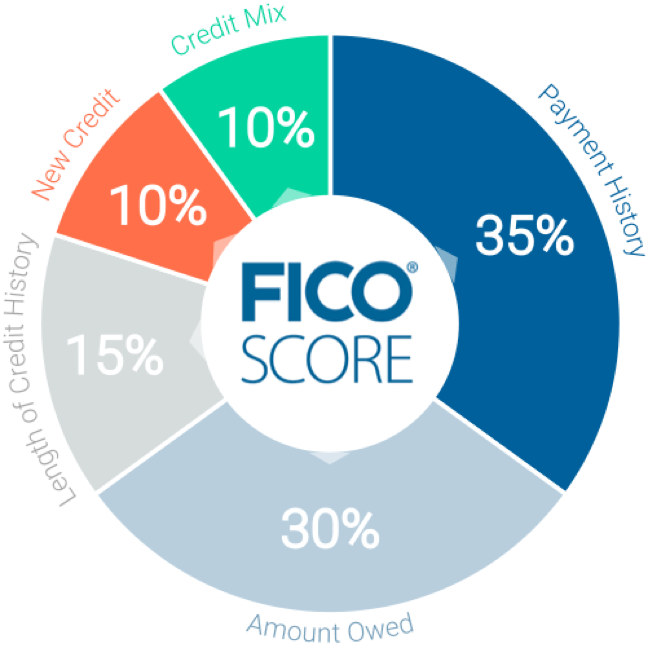

What goes into FICO® Scores?

- 35% – Payment history. Whether you’ve paid past credit accounts on time.

- 30% – Amounts owed. Amount of credit and loans you are using.

- 15% – Length of credit history. How long you’ve had credit.

- 10% – New credit. Frequency of credit inquires and new account openings.

- 10% – Credit mix. Mix of your credit, retail accounts, installment loans, finance company accounts and mortgage loans.

Ukrainian Federal Credit Union Credit Card holders will receive their updated FICO® Score 5 based on Equifax data, when available, on a quarterly basis. You’ll see this score on your monthly statement and within Online Banking, so you can stay on top of your credit and avoid surprises.

Curious about your credit report? Free weekly online credit reports are available from Equifax, Experian and TransUnion to primary account holders. Request yours online by visiting Annual Credit Report.

Credit Education Videos

Understanding Your Credit Report from FICO B2C Scores on Vimeo.

What is a FICO® Score? from FICO B2C Scores on Vimeo.

Which Credit Scores Matter from FICO B2C Scores on Vimeo.

CREDIT GALAXY

Ready to test your knowledge? Have fun while learning!

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Ukrainian Federal Credit Union and Fair Isaac are not credit repair organizations as defined under federal or state law, including the Credit Repair Organizations Act. Ukrainian Federal Credit Union and Fair Isaac do not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history or credit rating.